“Hey, I forgot my wallet. Can you cover me and I’ll pay you back?”

More than a phrase we have all heard or uttered at least once in our lives, it also inspired Founders Andrew Kortina and Iqram Magdon-Ismail to create the mobile payment app Venmo.

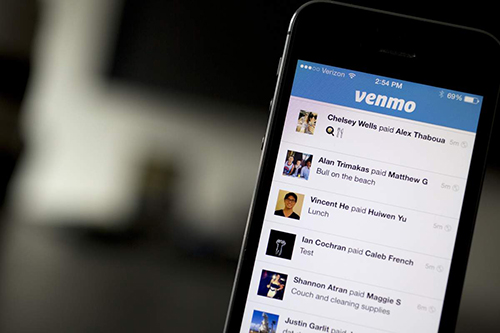

Headquartered in New York, Venmo launched publicly in August of 2012 and was acquired by Braintree for $26.2 million only five months later and then PayPal acquired Braintree in 2013 for $800M. The mobile-first app allows its users to trade money without ever physically touching it. Available on iPhones and Androids, users can get started by installing the free app and adding a bank account to withdraw and deposit money from. No cash, no checks, no problem.

Photo Credit: ABC News

Why is it called Venmo?

The simplicity of the idea – to exchange money on the go – is echoed in its name. On the Origins of Venmo, Kortina writes, “The brainstorming process was one of many we tried and was not important as the requirements. We were exploring the Latin root vendere ‘sell’ and ‘mo’ for mobile, but purely as a means to get to a name that (1) was short, 5-6 letters, (2) could be a verb, (3) didn’t have an unintuitive spelling and (4) was cheap. Venmo was available on GoDaddy and met the important criteria, so we grabbed it.” At the time, though, they weren’t exactly working on the same Venmo it is now.

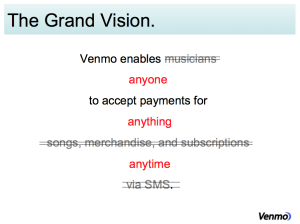

As is the case with many entrepreneurs, Kortina and Magdon-Ismail, who had been freshman roommates at the University of Pennsylvania, were actually working on another idea when they conceptualized the Venmo as we know it today. It was only after the development of a college classifieds site called “My Campus Post” and in between working for startups and building websites for anyone who would let them, that they built the first version of Venmo, one that dealt in MP3s instead of mobile payments. Kortina recalls a jazz show that got them thinking, “‘It would be awesome to be able to download this show by sending a text message to this band right now, and then have an mp3 show up in our email.’”

When they got together in Philadelphia in 2009 to build out the concept, Magdon-Ismail realized he’d left his wallet at home in NYC. Kortina paid for him and was later reimbursed via a check he never actually cashed. It led them to think, “Why are we still doing this? We do everything else with our phones. We should definitely be using PayPal to pay each other back. But we don’t, and none of our friends do.” Despite the shift in focus, the initial wireframe lent itself perfectly to Venmo 2.0.

SEE ALSO: Why is it called Square?

The about page describes Venmo as “a free digital wallet that allows you to pay and request money from your friends.” Users can add friends through their contacts and simply send money to a phone number with a note about what it’s for. Although the amount is undisclosed, the note is publicly visible and makes for an entertaining feed between friends. Scattered among rent and utilities payments, you’ll find memos for things like “relationship advice” and “an unfortunate series of events.”

Whatever the reason behind the payment, Venmo salutes the unwritten rules of friendship that enable participating parties to lend and borrow money at regular intervals. Better yet, it reinforces them; just don’t forget to cash out after you get a deposit. After all, it lets you keep your cash and your cool by making sure you never have to ask your friends for money again.

Thanks for reading “Why is Venmo called Venmo?” What’s the weirdest thing you’ve paid someone back for using Venmo? Comment below! #whyisitcalledVenmo

Annelise Schoups is a contributor at Rewind & Capture. With a degree in journalism, experience in public relations, and an education in travel, she is passionate about cultivating knowledge and storytelling.

[…] SEE ALSO: Why is Venmo Called Venmo? […]